- This tiny Bluetooth speaker delivers loud, distortion-free sound - and it's on sale

- 2025 Cyber Security Predictions: Navigating the Ever-Evolving Threat Landscape

- Not Just Another List of Top 10 Metrics You Should Measure

- My new favorite headphones for swimming come bundled in a unique charging accessory

- Why I recommend this Windows laptop to creatives and professionals - even if it's meant for gamers

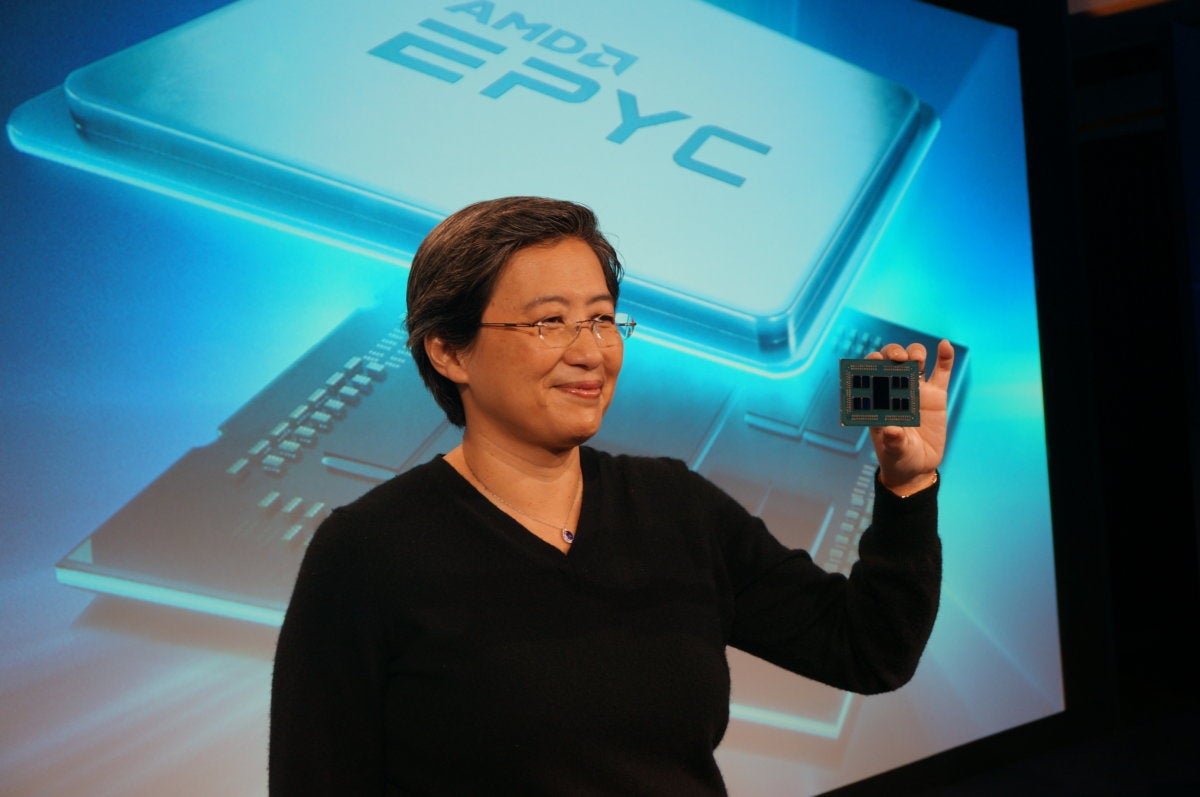

AMD posts operating loss, but solid growth for data center, embedded segments

AMD announced third quarter results this week, and while it posted a $64 million loss in terms of overall operating income—mainly due to its acquisition of Xilinx—but large gains in the company’s data center, embedded and gaming segments provided an encouraging note.

Total revenue rose by 29% for the third quarter of 2022, to $5.56 billion from $4.31 billion one year ago. Gross profit also rose in year on year terms, from $2.08 billion in last year’s third quarter to $2.35 billion for the past three months. The decline in operating income was caused by much higher operating expenses, which more than doubled in the third quarter, rising from $1.14 billion a year ago to $2.42 billion in the most recent figures.

AMD chalked the higher expenses up to its acquisition, in February 2022, of semiconductor company Xilinx, which cost the company roughly $50 billion. Additionally, higher spending on R&D also cut into AMD’s margins.

Investors appeared to focus on the good data center and embedded segment news, as AMD shares rose 3.7% to $61.83 in Thursday afternoon trading.

Data center uptake helps compensate for PC market decline

Like the rest of the semiconductor industry, AMD’s growth was slowed somewhat by the decline in PC sales. That part of the company’s business declined from $1.69 billion in the third quarter of 2021 to $1.02 billion this year. However, other parts of AMD grew significantly to compensate for that decline, with the company’s data center net revenue rising from $1.1 billion last third quarter to $1.6 billion in the latest numbers, which represents a 45% increase.

The Xilinx acquisition also helped bolster AMD’s numbers in the embedded sector – which is unsurprising given Xilinx’s focus on that area. The third quarter of 2021 saw AMD make just $79 million in net revenue from embedded products, while the latest quarter showed $1.3 billion in the same segment.

The company said that it credits growth in the data center market to positive sales numbers for its EPYC processors, which have helped it take substantial market share away from Intel. While the server processor market has largely belonged to Intel over the past decades, that company’s market share has fallen from 98% five years ago to 88%, as of May of this year. AMD’s estimates for future revenue are bullish, with the company predicting a roughly 14% year-on-year rise for its fourth quarter, to a total of approximately $5.5 billion. AMD also stated that it expects growth both in year-over-year and sequential terms for its embedded and data center businesses.

Copyright © 2022 IDG Communications, Inc.