- What to Do If You Book a Hotel or Airbnb and It Turns Out to Be a Scam | McAfee Blog

- Cómo evitar la fuga de cerebros en TI

- Is ChatGPT Plus still worth $20 when the free version packs so many premium features?

- How this 'FinOps for AI' certification can help you tackle surging AI costs

- ChatGPT can record, transcribe, and analyze your meetings now

Scaling the Adoption of Private Cellular Networks

Private networks are essential to every enterprise. Enterprises use private networks to integrate information systems into their operations and to continue their digital transformation through technology integration into business processes. Over the past twenty years, Wi-Fi has become an essential component of nearly every private network. Wi-Fi accelerates digital transformation and supports a wide variety of enterprise-specific value propositions.

Back in the early 2000s, Cisco’s own analysis estimated that Wi-Fi adoption by its employees was resulting in staff being 86 minutes more productive per day than their tethered counterparts. More recently, analysis of Wi-Fi adoption by retailers indicates improvements in top and bottom lines, with positive impact on customer loyalty, increased insights through the use of wireless network analytics and increased sales. Other examples include industrial predictive maintenance use cases that are delivering 10-20% increases in equipment uptime and 5-10% decreases in overall maintenance costs. One report indicates that Wi-Fi is being used in 34% of such deployments across different industry sectors. Finally, in sports and entertainment, digitization is transforming the fan experience. At the SoFi stadium, the private network uses a massive deployment of more than 2500 Cisco Access Points to deliver the fastest and most reliable fan experience, that is reported to have resulted in the most digitally engaged set of spectators.

Across all verticals, from carpeted office, through to retail, manufacturing and sports and entertainment, Wi-Fi based private networks have proved themselves adept at supporting the widest range of business needs and value chains.

In parallel with enterprise adoption of local-area Wi-Fi networks, several industry segments have integrated cellular wide-area technology into their business processes. The earliest use cases adopting wide-area cellular technology have focused on the benefits offered by the wide area coverage offered by public cellular providers. In contrast to the local-area private Wi-Fi networks, public cellular coverage supports nationwide service. Phone based systems that connect vehicle users have always been an important segment for public cellular providers. But now we see integration of cellular modem technologies into the latest utility meter offerings, where the cellular connectivity is able to provide near real time visibility of energy consumption to utility customers. The wide area coverage ensures that a uniform solution can be offered across a particular geography.

Transportation systems that integrate cellular modems leverage the same wide area capability. The latest connected warning signs now benefit from secure connectivity from road-side control cabinets to the central data centre. Fleet management solutions use wide area cellular connectivity to improve vehicle maintenance, lower fuel consumption as well as automated logging of odometers, rev-meters and accelerometers.

Over the years, public cellular providers have adapted their product and services to enable a range of different verticals to integrate cellular modems that benefit from wide area connectivity into their business processes while supporting a range of different business relevant value propositions.

The coverage advantage of public cellular systems has driven adoption by those use cases that necessitate national or international coverage. So called “metropolitan area network” use cases can similarly benefit from this coverage advantage. One of the earliest examples of such is the Australian regulator ACMA that permits use of 3GPP defined 1800 MHz cellular frequencies for supporting point-to-multipoint systems for private networks in regional and remote areas of Australia. This has led to the adoption of private cellular networks by mining and energy companies that have operations that span over significant distances and where the increased range of cellular based point-to-multipoint systems offer clear advantages compared to local Wi-Fi based unlicensed alternatives.

In the US, many utility companies used to operate private metropolitan-area networks based on WiMAX technology. These have now transitioned to private LTE based systems, enabled by the recent innovation in spectrum licensing associated with CBRS. Now airports are using these new licenses to operate private LTE networks, leveraging the extended range offered by cellular frequencies to enable better coverage of the apron where aircraft are parked to support baggage and maintenance use-cases.

In the UK, from 2019, Ofcom took the decision to augment its approach to licensing spectrum for cellular operation, with the introduction of shared access to spectrum for a newly introduced 5G band. The specific 5G band covers 400 MHz of spectrum between 3.8 and 4.2 GHz. Ofcom’s rationale for the novel approach was to “enable the deployment of private networks with greater control over security, resilience and reliability”. Ofcom has made two types of local license available:

- a low power license that authorizes the licensee to deploy as many radio access points within a 50 metre radius of a defined reference point. The radio access points have a maximum emitted power of 24 dBm (for a 20 MHz carrier) and an antenna height limited to 10 metres above ground.

- a medium power licensed that authorizes the licensee to deploy a single radio access point at a defined rural location where the radio access point has a maximum emitted power of 42 dBm (for a 20 MHz carrier).

Previously businesses wanting to benefit from integrating cellular service into their business operations had to engage with public cellular operators that had been licensed exclusive spectrum. Now, these new regulatory approaches are allowing businesses to deploy local and metropolitan cellular systems independently of public operators.

5G is targeted at fulfilling the requirements from different industrial segments. In order to meet such expectations, 3GPP Release 16 defines enhancements to the 5G system to support Non-Public Networks (NPNs). This introduces two new cellular identifiers, a Non-Public Network Identity (NID) and a Closed Access Group Identity (CAG-ID), enabling devices to perform non-public network identification, discovery and selection as well as enabling the NPN to implement access controls. In release 16, the NPN can be deployed in two different configurations:

- “stand-alone” mode (S-NPN) where the NPN is deployed in isolation of a public cellular network, and

- in“public network integrated” mode (PNI-NPN) where the NPN leverages 5GS functionality delivered by the public cellular network, including SIM/identity management.

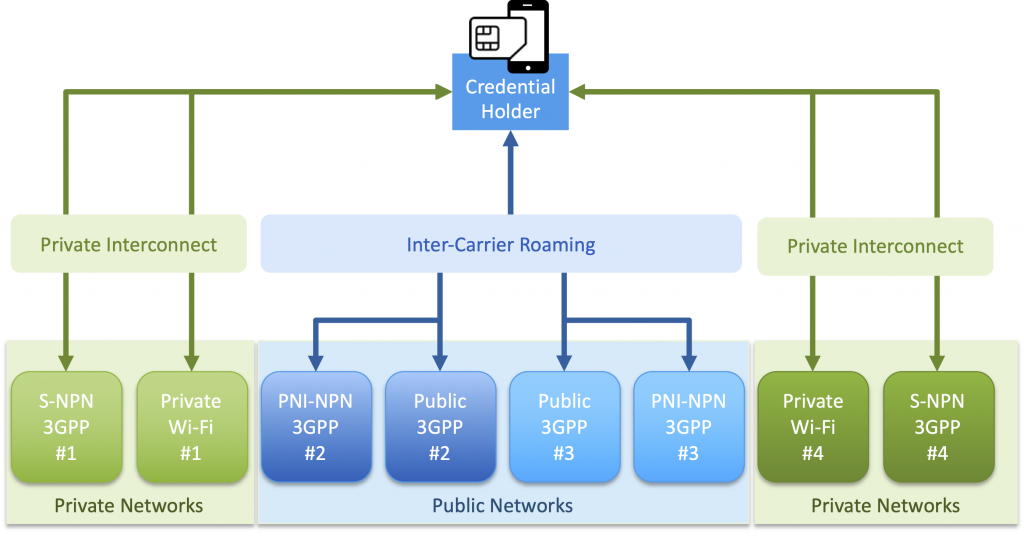

The PNI-NPN deployment can, subject to agreed policies, enable an enterprise device to seamlessly transition between the NPN access network and the public cellular network. In contrast, the Release 16 S-NPN is considered isolated from other networks. However, release 17 has seen further enhancements with the ability for a device to access the S-NPN using credentials owned by a separate credential holder (CH) entity. The credential holder can be a private enterprise, or can be a public cellular operator, enabling a SIM-based public cellular identity to be used to authenticate a device on an S-NPN. Note, whereas such a scenario would conventionally be referred to as “roaming”, 3GPP’s use of roaming is limited to using another public cellular operator’s visited network and hence 3GPP refers to authentication between S-NPN and CH as “interworking”.

These latest NPN capabilities, when coupled with the new approaches to licensing cellular frequencies, are specifically aimed at broadening the applicability of private cellular networks to the widest range of businesses.

Operating interconnections between networks, be that peering interconnect, an ISP service or roaming, always requires a technical framework and a financial framework that are referenced in terms defined in legal agreements agreed between parties.

The GSM Association came into existence to drive matters essential for the implementation of a pan European roaming service. Since its inception back in the 1990s, GSMA’s remit has since broadened to address services and solutions that underpin interoperability and make mobile work across the world. Serving its operator members, GSMA defines how to operationalize the roaming reference points defined by 3GPP to enable their operator members to support international roaming. This includes defining international roaming agreements, operating systems to enable collecting and sharing roaming related business and technical information, and procedures that enable the exchange of roaming signalling between different operators.

In contrast to the unified inter-operator cellular system operationalized by GSMA, historically the private wireless industry has taken a decentralized approach, with each individual wireless hotspot provider defining their own legal terms and getting end-users to agree to those before being able to access via the private network. This decentralized approach has not inhibited private wireless hotspot adoption, with some estimates of over 500 million Wi-Fi hotspots available worldwide. However, more recently it has inhibited usage, as users avoid the required user engagement necessary to accept the hotspot’s legal terms.

How to scale interconnect is a significant issue for private networks. While GSMA has been successful in scaling roaming between the 800 public cellular operators, there are still challenges in scaling GSMA interconnect. This requires the use of roaming hub providers to scale operations. Importantly, such hub models are predicated on the use of financially settled service that can be used to pay for the services of the roaming hub provider. In contrast, the businesses that have deployed private wireless networks frequently do not require financial remuneration from another enterprise in exchange for providing access, be that from a third party private enterprise or a public cellular operator. Without financial remuneration to enable conventional hub models, an alternative approach to scaling may be required for private networks.

Another key aspect of scaling private networks is related to the dimensioning of inter-connected signalling that is a function of the geographical coverage of the private wireless access network and the number of subscribers served by a particular credential holder. Public cellular networks provide nationwide coverage to 10s of millions of subscribers. Such scale drives significant roaming signalling traffic between cellular providers that enable assumptions related to longevity of signalling connections to be embedded into technical procedures that support bidirectional signalling between all public cellular operators. In contrast, early data from the Wireless Broadband Alliance (WBA) on adoption of its OpenRoaming federation, a system designed to operate with private wireless networks, indicates that dimensioning in private deployments may be as low as one thousandth of that experienced by a conventional public cellular network.

With some forecasting 1 million private cellular networks by the end of the decade, a thousand times the current number of public cellular networks, we can anticipate the future scalability challenges of being able to support 1000 times more networks, each with 1/1000th of the signalling load.

The opportunity of being able to interconnect 3GPP Non-Public Networks with third party systems is aimed at fulfilling 5G’s opportunity at serving different industrial segments. The challenges faced include defining the technical framework to simplify adoption of interconnect functionality, agreeing procedures that are amenable to the administrators of information technology (IT) and operation technology (OT) systems in separate businesses while simultaneously supporting the unique scaling attributes of private networks and separate credential holders.

Complementing the technical framework, a legal framework that enables legal teams in private enterprises, individual credential holders and public cellular operators to scale is required. The legal terms need to ensure cellular devices, be that end-user smartphones or embedded cellular modems, experience a great service when using the private wireless networks. Finally, the interconnect systems should not assume that financial remuneration for providing wireless service is going to be available to fund the operation of hubs to scale interconnect across the millions of private networks.

Simplification and scaling of private 5G solutions is going to be critical to ensure the full potential of 5G can be harnessed. The 5G DRIVE (Diversified oRAN Integration & Vendor Evaluation) project led by Virgin Media O2 and part-funded by the UK DCMS, Cisco and co-partners is targeted at defining the use of the new 5G Security Edge Protection Proxy (SEPP) roaming interface to connect public and private 5G networks. Cisco is invested in solving the key problem of how best to integrate private 3GPP Non-Public Networks with established public cellular networks, affordably, securely and at scale. Cisco will use its membership of the 5GDrive project to showcase its 5G-as-a-Service offer that is aimed at lowering the barriers to adoption for 3GPP Non-Public Networks as well sharing key learnings from its incubation of the OpenRoaming systems from an internal Cisco proof-of-concept to an industry standard supporting roaming across over a million private hotspots. Watch out for upcoming blogs where we will be sharing more information about proof of concept demonstrations of how SEPP-based roaming could be adapted to lower barriers to adoption for private enterprises.

Want to find out more?

- Click here to learn more about how OpenRoaming is already lowering barriers to adoption for roaming onto private Wi-Fi networks.

- Click here to learn more about Cisco’s private 5G-as-a-service offering.

Share: