- This handy USB meter tells you what's actually going on with your ports - and it's only $20

- This budget Lenovo ThinkPad has no business being this good - especially for hybrid workers

- Déjà Vu: What Cloud Adoption Can Teach Us About AI in Cybersecurity

- Motorola to outfit first responders with new AI-enabled body cameras

- CIOs highlight negotiation opportunities as AWS and Google lower cloud costs

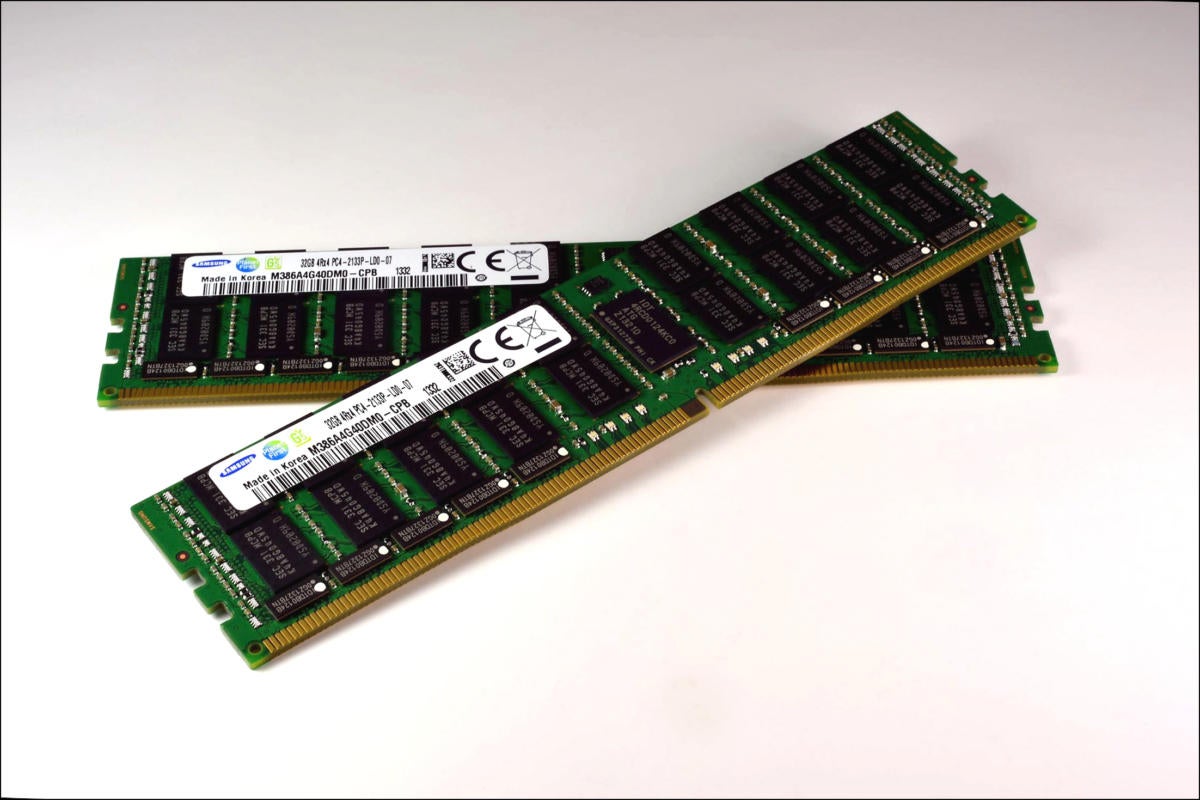

Server DRAM to exceed mobile DRAM, as enterprises adopt emerging tech

Semiconductor manufacturers will respond to changes in demand by producing more dynamic RAM (DRAM) for servers than for mobile devices this year, a milestone that highlights increasing enterprise use of emerging technology related to cloud computing, AI and high performance computing (HPC) applications, according to market research firm TrendForce.

To handle the emerging-tech workloads, the average DRAM content of servers will increase by 12.1% year-over-year in 2023, compared to an increase of 6.7% for DRAM content for smartphones, TrendForce forecasts. DRAM content refers to the amount of DRAM memory installed in a device.

In a related estimate, server memory chips this year are expected to make up 37.6% of what TrendForce determines to be the total bit output of DRAM semiconductors, compared to mobile DRAM’s 36.8%, the company said in its latest DRAM research report.

While AI and HPC workloads contribute to increasing need for server DRAM, the pandemic-fueled expansion of cloud services also is a factor, TrendForce said.

“Owing to the influence of the COVID-19 pandemic, the market for cloud services has expanded considerably and thereby caused a sharp increase in both server shipments and the average memory content of servers,” TrendForce said. Because of this, demand for solid state drive (SSD) arrays with DRAM — generally considered well-suited for HPC and big data workloads because of their fast speed — will grow, the company said.

Market analysis company Market Research Future also points out that over recent years, there has been a consistent increase in the demand for server DRAM, which can be attributed to the rapid use of consumer electronics that use services hosted on servers in data centers.

Going forward, more DRAM memory will be shipped for servers than for smartphones, according to TrendForce, though the company did not quantify how much DRAM will be shipped.

Meanwhile server DRAM capacity for smartphones has been stifled by supply chain issues due to pandemic disruptions, TrendForce said. “When developing devices slated for release during 2022, brands mainly stayed with the hardware specifications that could be provided by the components within their existing inventories. This approach thus constrained the DRAM content growth,” according to the TrendForce report.

While supply chain and inventory problems are being resolved, TrendForce forecasts that the growth rate for DRAM content for mobile phones will stay below 10% for “the next several years” — below that for servers.

“Moving into 2023, the projections on the growth of smartphone shipments and the increase in the average DRAM content of smartphones remain quite conservative,” TrendForce noted.

Copyright © 2023 IDG Communications, Inc.