- I recommend the Pixel 9 to most people looking to upgrade - especially while it's $250 off

- Google's viral research assistant just got its own app - here's how it can help you

- Sony will give you a free 55-inch 4K TV right now - but this is the last day to qualify

- I've used virtually every Linux distro, but this one has a fresh perspective

- I replaced my JBL speaker with this surprise alternative. Here's why it's my new top pick

Taking the risk out of the semiconductor supply chain

Over the past few years, the tech industry has been feeling the impact of unprecedented disruptions along the semiconductor supply chain. This supply chain—which spans from research and development to manufacturing, to the end use of the tiny chips that enable devices from cars to cell phones—has historically been volatile, easily swinging from surpluses to shortages due to geopolitical and global economic factors. Yet, while the industry’s cyclicality may never change, a more secure and reliable system to safeguard and diversify the global supply chain is possible.

Addressing semiconductor supply chain risks

Even before the most recent supply chain challenges, political leaders around the world have been taking a close look at the current semiconductor supply chain model. Semiconductors across the global economy have the potential to shape supply chains for numerous commercial electronics, as well as components essential to critical infrastructures, such as telecommunications and financial services. Perhaps more importantly, the supply of semiconductors has worldwide security implications, affecting national and regional defense and emergency response capabilities. Given its geopolitical impact, many policymakers concluded that the existing semiconductor supply chain model is too risky and are responding accordingly.

Some of that risk is being addressed at national and regional levels, such as the U.S. CHIPS Act and the EU Chips Act. However, investments in these initiatives are heavily focused on building new wafer fabrication facilities, or “fabs.” While fabs make up a critical part of the manufacturing process, increased fab production alone cannot better secure the global supply chain.

Broadcom

There is much less awareness of what happens after chips leave the fab. These post-fab processes—what the industry calls “downstream” or “back-end” operations—comprise a critical part of the chip-making supply chain and they, too, remain highly vulnerable.

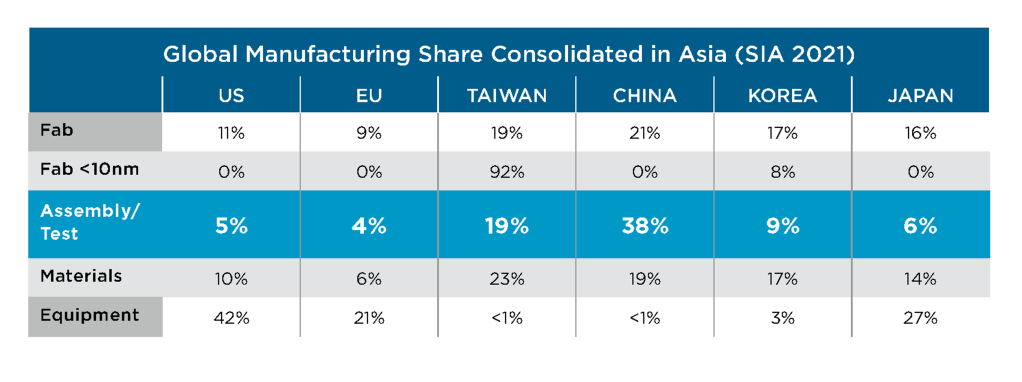

A 2021 report by the Semiconductor Industry Association (SIA) highlights that the overwhelming majority, nearly 80%, of the world’s semiconductor wafer fab manufacturing is done across just four countries in Asia, while less than 10% is done in Europe. And when it comes to manufacturing the world’s most technologically advanced chips, none of it occurs in Europe or the U.S.

Source: SIA 2021 State of the Industry report

Wafer fabrication is the most well-known piece of the semiconductor manufacturing supply chain, but there are other necessary steps that take place after chips leave the fab and before they end up in a smart phone or automobile. Nearly all post-fab steps are likewise concentrated in those same four countries in Asia. In fact, Asia is home to more than 90% of the post-fab, downstream supply chain, with only 4% in Europe.

Creating a European-based post-fab ecosystem

A specialized, geographically dense downstream supply chain faces numerous risks, ranging from natural disasters to regional or global geopolitical disruptions. To fully safeguard the semiconductor supply chain, fabrication as well as the post-fab processes need to be diversified.

There is no magic solution to this challenge. The near-term capital and operational expenditures to build downstream processes in the U.S. and Europe are substantial, albeit they are nowhere near as large as what’s required for building a new fab.

But these costs are not insurmountable. Public funding would help meet the upfront costs of building and operating downstream infrastructure ecosystems. The EU and its member-states could encourage investment in fabs andthe critical parts of the post-fab supply chain that follow.

Without that commitment from the public sector, private corporations may not be willing or capable of overcoming these challenges on their own. More importantly, the opportunity to advance an increasingly secure global supply chain could be lost without it.

Diversifying the current supply chain

Supply chain diversification is not only in Europe’s security interests, but it is also in the broader interests of countries globally—including the U.S., which acknowledges the need to remove risk from the current supply chain. In fact, a more secure and diversified supply chain was singled out as a shared goal of the U.S.-EU Trade and Technology Council. However, this should be more of a worldwide effort across Europe, the Americas, and Asia in order to eliminate vulnerabilities in the entire supply chain.

As a global company that stands to benefit from a more secure supply chain, Broadcom, a global semiconductor and infrastructure software provider, would welcome opportunities to improve its downstream manufacturing diversity. Safeguarding the supply chain, including the post-fab processes, can reduce the likelihood of disruption from a host of potential events for not only commercial industries, but also governments investing in critical technologies that range from advanced telecommunications to cloud infrastructures.

So, as European and American governments consider their own investments, they must not lose sight of the big picture. Building fab capacity is not the only solution to the supply chain risk puzzle. Looking beyond the fab and securing downstream processes could have significant, positive impacts on global stability and the protection of the supply chain worldwide.

For more information about Broadcom’s semiconductor innovations, visit broadcom.com/blog.

About Hock Tan:

Broadcom Software

Hock Tan is Broadcom President, Chief Executive Officer and Director. He has held this position since March 2006. From September 2005 to January 2008, he served as chairman of the board of Integrated Device Technology. Prior to becoming chairman of IDT, Mr. Tan was the President and Chief Executive Officer of Integrated Circuit Systems from June 1999 to September 2005. Prior to ICS, Mr. Tan was Vice President of Finance with Commodore International from 1992 to 1994, and previously held senior management positions with PepsiCo and General Motors. Mr. Tan served as managing director of Pacven Investment, a venture capital fund in Singapore from 1988 to 1992, and served as managing director for Hume Industries in Malaysia from 1983 to 1988.