- I recommend the Pixel 9 to most people looking to upgrade - especially while it's $250 off

- Google's viral research assistant just got its own app - here's how it can help you

- Sony will give you a free 55-inch 4K TV right now - but this is the last day to qualify

- I've used virtually every Linux distro, but this one has a fresh perspective

- The 7 gadgets I never travel without (and why they make such a big difference)

The Era of Private Wireless Has Begun

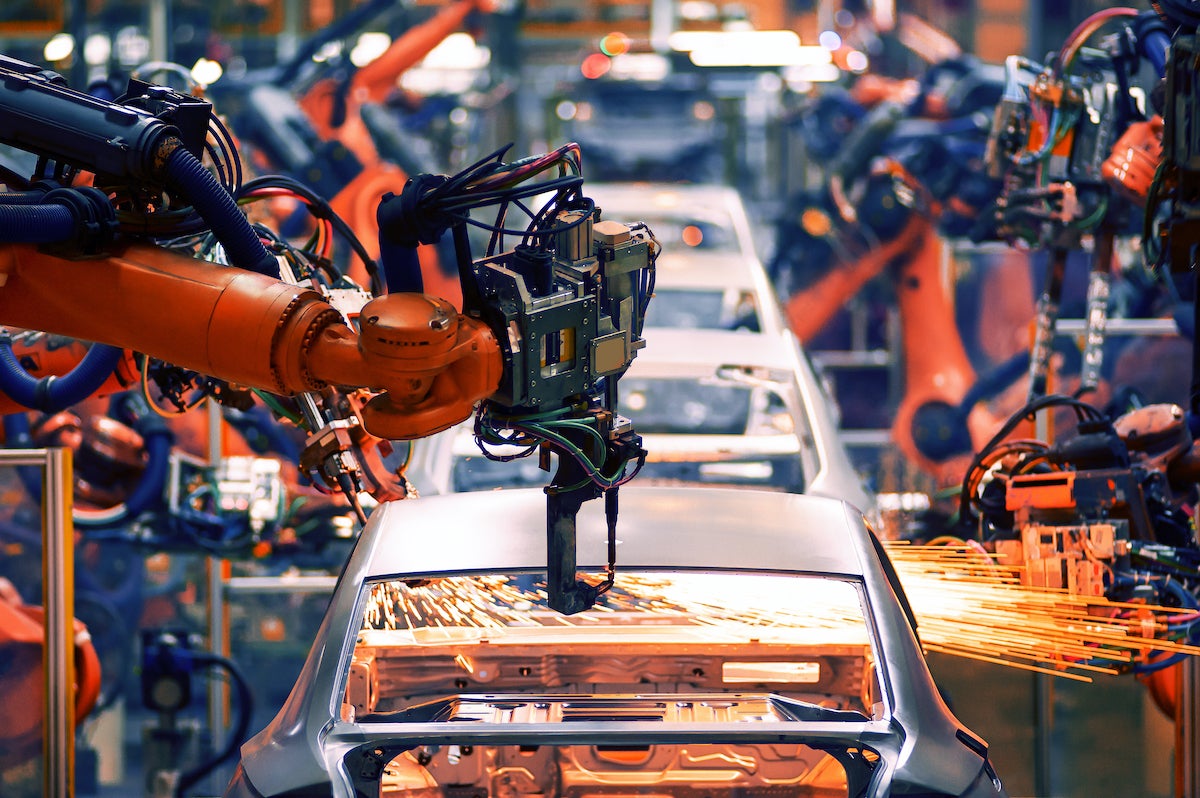

Over the last decade, a number of technological trends have come together that will transform our industrial society and introduce a high level of automation to many of our processes. Robotics, artificial intelligence (AI) and machine learning (ML), the cloud, and digital twins technology are ushering in the era of Industry 4.0. Asset-intensive industries are moving quickly to take advantage of these technologies, including manufacturing, ports, mines, utilities, railways, airports, logistics, intelligent highways, and smart cities. The list is long and growing quickly.

An often-overlooked ingredient in making all of this possible is industrial-strength wireless connectivity or “private wireless.” The key Industry 4.0 technologies that are usually discussed are AI/ML, which will enable the automation of highly complex processes, and Internet of Things (IoT) sensor technology. IoT technology will allow us to get data from many physical processes, which can be modeled to create digital twins for AI-driven optimization. Distributed cloud technologies, such as multi-edge computing (MEC), will provide the processing power required for AI/ML to process the enormous amounts of data created by IoT. But connecting all this together will require very robust and secure wireless.

In early trials of Industry 4.0 automation, operations technology (OT) engineers often took for granted existing IT technologies such as cabled Ethernet and Wi-Fi to provide the data connectivity. But the limitations of these technologies were quickly made evident. Cabling is reliable, secure, and high performance — so it will stay — but it is expensive. Adding hundreds and thousands of sensors isn’t scalable with cabling. As well, many of the processes have moving parts that demand wireless.

Wi-Fi also has its limitations. It is an IT technology mostly intended for providing best-effort connectivity in offices. In ideal situations, it can perform well, especially the latest Wi-Fi 6 standard. However, the majority of industrial settings are less than ideal. Whether it is a factory, a mine, or a sea port, there are a lot of metal surfaces that create radio interference, and the environment changes rapidly.

Wi-Fi also doesn’t have enough coverage for high-ceilinged indoor and large outdoor areas, and it doesn’t really support mobile applications. It can handle pedestrian-speed handoffs from one access point to another, but even then, it isn’t predictable when doing so. Early autonomous mining truck trials would often result in trucks grinding to a halt as they scanned for the next Wi-Fi access point to get a connection. If we had to rely on Wi-Fi, it is no exaggeration to say that many of the promises of Industry 4.0 would be unrealized.

The search for a robust, predictable, and secure wireless technology eventually led OT engineers to cellular technologies, 4G/LTE, and 5G. Designed to provide mobile connectivity for masses of people, cars and, even, high-speed trains, handling mobile applications in industrial settings was not an issue. As well, cellular was designed to handle the kind of intense radio interference that occurs between skyscrapers in dense urban cores, where there are a lot of moving metal objects, new construction, and shifting populations of users. It was also designed from the ground up to be highly secure, requiring all devices to have SIM cards for access to the network, and employing encryption end to end.

The reason 4G/LTE wasn’t an obvious choice from the beginning was that the radio spectrum it uses is government regulated and the licenses had mostly been allocated to mobile operators at enormous expense. Some mobile operators were willing to share it with industry, but they wanted to pass on the cost of their licenses; so, it often proved uneconomical for the OT use cases industrial engineers were designing. They resorted to Wi-Fi in some cases, used cabling, despite its cost, and employed lower bandwidth unlicensed spectrum wireless technologies for IoT sensors (SigFox, LoRa, BLE, etc.). The solutions were often complex and point solutions for one application often ended up interfering with an adjacent solution. As they contemplated scaling Industry 4.0, it was clear that this wasn’t a long-term viable strategy.

As the standards work for 5G began around 2015, the industrial use cases for 5G wireless were foremost in everyone’s mind. 3GPP, which sets the standards for 4G/LTE and 5G, as well as a number of industry stakeholders such as AGURRE in France, worked closely with the world’s governments and began to lobby for the release of new spectrum specifically for industrial use. Governments, understanding the promise of 5G, began looking for ways to share spectrum being under-utilized or to release bands that they had in reserve. New private spectrum bands are now being made available around the world and mobile operators are also more willing to lease spectrum and offer private wireless to their customers. The era of private wireless has begun.

While early 5G networks currently exist, the 5G standard is still being finalized, especially around some of the key industrial use case requirements. It is expected to be completed in the 2022-2023 timeframe, and then it will take a couple of years for the right device chipsets to come, and more time for the industrial equipment and device eco-system to fully develop.

In the meantime, 4.9G or advanced LTE, which is the latest version of the existing standard, has already adopted many features of 5G. For instance, it has the ability to support low-powered connectivity for IoT sensors and provide very reliable, secure, and predictable performance. It also employs a virtual, cloud-native core architecture that can use edge computing to reduce latency in critical machine-to-machine communications, which is essential in automation where the time between action and reaction has to be as small as possible.

As companies look to the future and the digital transformation of their operations, they need to be aware not only of the promise of 5G, but that 4.9G/LTE is already available and, when used in private wireless networks, can tackle the majority of industrial use cases with a step change in performance and reliability compared to Wi-Fi. There are also completely unlicensed LTE technologies, such as MulteFire, that use the same spectrum as Wi-Fi.

The cost of 4.9G/LTE access points is higher than Wi-Fi, and there is a learning curve involved in managing these more feature-rich wireless networks. However, management software has been simplified for enterprise use and, for most industrial sites, the total cost of ownership (TCO) is very favorable. The lower TCO is based on several factors, but some of the main reasons are that 4.9G/LTE small cells provide very large coverage and a private wireless network is “deploy and forget”— based on the ability of 4.9G/LTE to work with interference and to adapt coverage to fast-changing environments.

Stephane Daeuble, head of marketing for Nokia’s enterprise solutions division, illustrates these advantages with two examples: “Nokia has worked with a large open pit mining operator that was able to cover the operational area with one-tenth the number of access points by using private wireless to replace the existing Wi-Fi network. The Wi-Fi network had previously required re-tuning every week to 10 days as the shape of the mine’s landscape was altered and interference patterns changed. This was never an issue for the 4.9G/LTE network.”

In his second example, Daeuble referenced a Nokia private wireless installation for an advanced manufacturing facility in North America. “The high ceilings meant that the Wi-Fi access points provided very little coverage on the ground, and antennas had to be directionally tuned. The Wi-Fi radio engineering study in this case would have taken one month to complete and the consultation fees would have exceeded the capital costs of the entire 4.9G/LTE solution — which required no special radio engineering.”

Nokia

NokiaNot all industrial use cases will require the reliable performance of private wireless, but once the network is in place, it replaces almost all previous networks. Not only Wi-Fi, but even low-bandwidth sensor networks, old serial networks for operational controls and push-to-talk private radio services. This means a dramatic reduction in operations costs.

Many Industry 4.0 use cases can be realized today using 4.9G/LTE private wireless. Evolution to 5G from this standard has been anticipated by the standards body, and it will be easy to operate in a hybrid 4.9G-5G setup for many years, adding the 5G performance characteristics for only those applications that need it.

Nokia has more than 220 private wireless customers worldwide and is considered the private wireless market leader by many industry analysts. We will work with you to determine what you need to digitalize your processes in order to pursue your own Industry 4.0 goals. We also have a number of digital-automation enabler applications and edge computing solutions that work directly with our private wireless, as well as a large ecosystem of device and sensor partners with whom we’ve done pre-integration work. Our professional services include design, operations and consulting to provide you with whatever level of support you need to implement your private wireless solution.

Copyright © 2021 IDG Communications, Inc.