- Your Ray-Ban Meta smart glasses just got two significant upgrades for free - what they do

- I found a Bluetooth tracker for Android users that works better than AirTags (and is cheaper)

- Learn with Cisco at Cisco Live 2025 in San Diego

- This Eufy robot vacuum has a built-in handheld vac - and just hit its lowest price

- I highly recommend this Lenovo laptop, and it's nearly 50% off

Communication Service Providers: the Potential Power Behind an Inclusive Internet

Gartner defines communication service providers (CSPs) as those who offer telecommunications services, media, information, content, entertainment, and applications services over networks. We know them as our telecommunications companies, our cable service provider, our satellite broadcast operators, and our cloud communications providers. CSPs are arguably the most important players to enable an accessible, affordable, secure, trustworthy, sustainable, and inclusive internet. But, to play a leadership role in defining the Internet for the Future, CSPs must fundamentally transform.

CSP industry economics are challenging

The current economics of the CSP industry are challenging. CSP market cap share of the internet (including infrastructure, connectivity, devices, and value-add digital services) fell from just under 30 percent in 2010 to less than six percent in 2021. CSP revenue growth is now at low single-digits at best and return on invested capital (ROIC) is barely above the cost of capital. Meanwhile, CapEx as a percentage of revenue has remained high as leading operators such as AT&T, Verizon, and Deutsche Telekom roll out their 5G networks.

CSPs must transform

To play a leadership role in defining the Internet for the Future — while also delivering positive returns to shareholders — CSPs will need to fundamentally transform. The next five years are crucial as CSPs plan to invest about $2 trillion in their networks, especially to connect rural areas and provide access to the economically disadvantaged. These companies will need to increase their ROIC by more than three percentage points, meaning boosting annual top-line growth by at least four percent, reducing operating costs by at least 10 percent year-over-year, and reducing CapEx intensity of their business by at least five percent. Achieving these benchmarks will require a fundamental rethink of the CSP business model. In the remainder of this post, we offer a road map for achieving this.

Roadmap to success: transition to platform business model

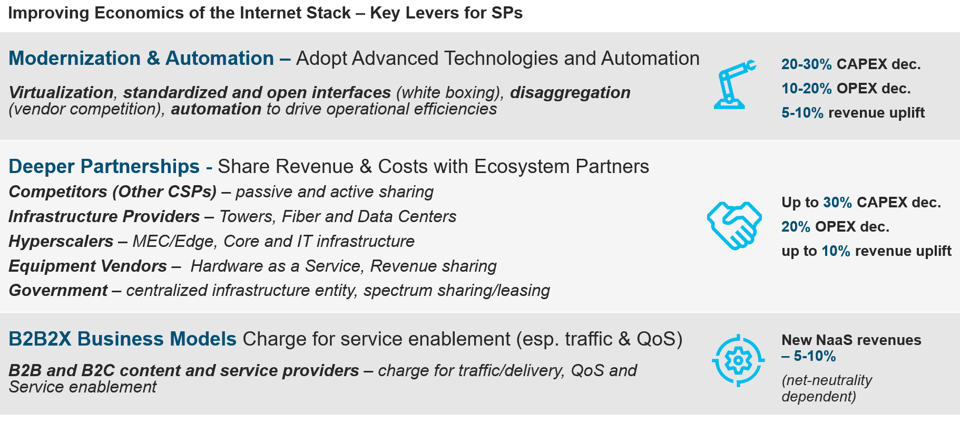

The primary shift for CSPs will be to create a platform architecture and business model to provide open-access connectivity to any service provider: a “connectivity platform as a service” (CPaaS). This layer is enabled by connectivity infrastructure as a service (CIaaS), which in turn enables customer-facing everything as a service (XaaS). Platforms lead to innovation speed by leveraging third party development. Three key areas will define success in delivering the Internet for the Future: modernization and automation, deeper partnerships, and B2B2X business models.

Modernization and automation

CSPs will need to make major shifts in their technology architecture to take advantage of potentially massive new opportunities. Investments in these five network domains will make possible a higher degree of automation and virtualization:

- Service and infrastructure orchestration. CSPs can move toward a leaner, cloud-native operations support system (OSS) and to ground their business support system (BSS) in microservices that are decoupled from outdated legacy infrastructure, opening new business opportunities and monetization models.

- Access. CSPs can use a virtualized radio access network (VRAN) or an open radio access network (ORAN) to drive disaggregation and standardization, leading to increased vendor diversity and new partnership models while reducing the total cost of ownership across upgrade cycles. CSPs with strong integration capabilities can see significant cost savings and time-to-market benefits.

- Edge/MEC. Multi-access edge computing (MEC) provides an excellent platform for delivering business and consumer services while deriving the fullest value from network infrastructure. In addition, operators can benefit from the broader MEC application market to drive monetization of new and emerging 5G use cases. This is an area that will require major investments as operators increase the coverage, capability, and capacity of their MEC networks.

- Transport. Convergence and delayering provide a great opportunity for service providers to make their transmission networks simpler and more intelligent, unlocking capacity while simultaneously reducing CapEx and supporting delivery of new revenue streams through network as a service (NaaS) offerings.

- Core. 5G core deployments will enable network slicing, which will help drive new organic service revenue while further strengthening NaaS capabilities. Public-cloud offerings will help a broader range of CSPs handle ever-increasing core workloads.

Software defined networks (SDNs) and network functions virtualization (NFV) will help decouple software and upgrade cycles and lower the costs of upgrades and maintenance. In turn, increased virtualization and open standards will enable service providers to design, configure, and manage network capacity more efficiently. Similar benefits can be achieved in flattening transmission networks (e.g., with Routed Optical network solutions) where current design rules, lack of visibility, and manual configuration result in over-dimensioning and over-provisioning. Legacy transmission networks run at an average utilization rate of less than 30 percent. VRAN and ORAN will both extend these life cycles and increase the use of third-party hardware. The lengthening of life cycles, along with a reduced need for manual upgrades and repairs, will help improve productivity in network functions.

CSPs must invest in deeper partnerships

CSPs will not be able to deliver the Internet for the Future unless they fundamentally change the way they think about and implement partnerships.

- Hyperscalers would benefit from CSP points of presence such as central offices and base-band locations. In return, hyperscaler investments in MEC could help service providers tap into the broader application-developer market.

- Infrastructure Providers. While CSPs already have models in place to share towers, fiber and data center virtualization and open standards will allow for more sharing in areas such as RAN.

- Carrier-neutral infrastructure providers. Tower companies and data centers are also well-positioned to drive MEC growth and could be ideal partners for service providers and hyperscalers, helping to drive standardization within markets. However, this model has limitations in terms of monetization and may raise concerns related to the hosting of CSPs’ organic networks and IT workloads.

- Equipment vendors. CSPs can deepen their partnerships with equipment vendors, like Cisco, to manage equipment as a service, shifting CapEx to OpEx —thereby sharing investment risks and rewards.

- CSPs could consider partnering with their competitors (other CSPs serving the same markets) in areas ranging from infrastructure sharing to active co-investment efforts.

- Solidifying government partnerships will be needed. For example, we must support the creation of a centralized infrastructure entity within single nations, as we have seen in Australia, Singapore, Mexico, Jordan, and elsewhere. Such partnerships could help CSPs cut CapEx and operational expenses.

Implementing B2B2X business models

Finally, these rising technologies will be levers not only for savings, but also growth—the kind of growth that CSPs urgently need to remain competitive and deliver on the infrastructure of the future internet. One promising avenue for growth is the boosting of consumer ARPU growth with differentiated, personalized offerings. The rollout and adoption of 5G will help enable this, especially as the metaverse evolves.

Aligning with Cisco’s purpose

It’s clear that the Internet for the Future needs to be more accessible, broadly distributed, secure, trustworthy, and ecologically sustainable. And it needs to achieve these qualities while also becoming even bigger, faster, and more capable than it already is. If CSPs can embrace transformation, they can become one of the most consequential drivers of an inclusive internet for all.

Learn more

Remember, as we consider the Internet for the Future our way forward has to begin with awareness of the important issues we face with internet inclusivity. You can learn more about our commitment to powering an inclusive internet for all with these resources:

Share: