- Learn with Cisco at Cisco Live 2025 in San Diego

- This Eufy robot vacuum has a built-in handheld vac - and just hit its lowest price

- I highly recommend this Lenovo laptop, and it's nearly 50% off

- Disney+ and Hulu now offer prizes, freebies, and other perks to keep you subscribed

- This new YouTube Shorts feature lets you circle to search videos more easily

Fraud in 2022: Five Things You Need to Know

If you’ve noticed changing patterns of fraud and the way your business manages fraud threats since the start of the pandemic, you’re not alone. Our latest survey of industry trends, with MRC and Verifi, the 2022 Global Fraud and Payments Report, highlights some important shifts in the extent of fraud and the way merchants are responding to it. It also reveals what merchants really think about upcoming rule changes.

Here are the key take-outs for 2022:

Fraud is on the rise…

For the second year running, fraud KPIs are on the rise. Estimated global revenue lost to fraud is up 16% — and in North America there was a sharp jump of 38%.

% of revenue lost to fraud 1

Cybersource

…but spending on fraud is not

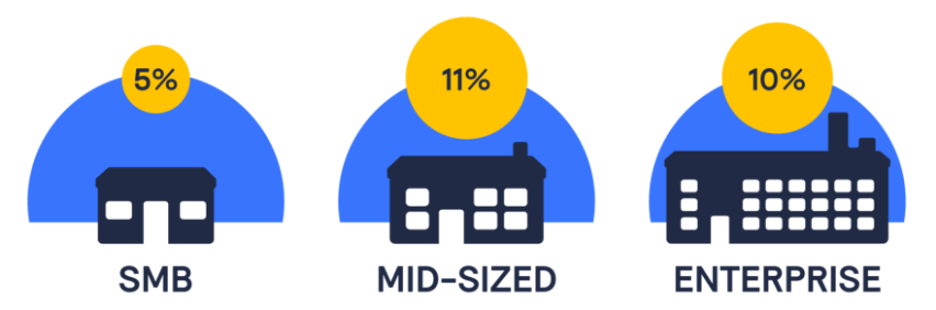

Despite the uptick in fraud, the overall amount merchants have spent on tackling fraud globally has flatlined since 2020. One explanation could be that managing fraud already accounts for a large proportion of merchants’ budgets. On average one-tenth of e-commerce revenue is spent on the issue. It’s a particular drain on resources for mid-sized firms:

% of eCommerce revenue spent managing fraud, by business size 2

Cybersource

Reducing manual reviews is in merchants’ sights

Given the significant ongoing costs of fraud management, it’s little wonder the majority of merchants are looking to reduce the amount spent on time-consuming manual reviews.

While most merchants foresee retaining a manual review process, 12% are planning to eliminate it entirely. In Europe this figure is even higher, with nearly one in five merchants planning a complete phase-out.

Role of manual review in future fraud management strategy 3

Cybersource

Merchants have a diverse armory

Fraud threats are a complex and constantly shifting threat, and merchants commonly use a number of approaches to tackle them.

On average, merchants use four different tools when detecting and thwarting fraud, although merchants who are members of the Merchant Risk Council typically use double that. Larger merchants also use a wider array of approaches than SMBs.

Global top five fraud-prevention methods 4

Cybersource

Changes are no big surprise

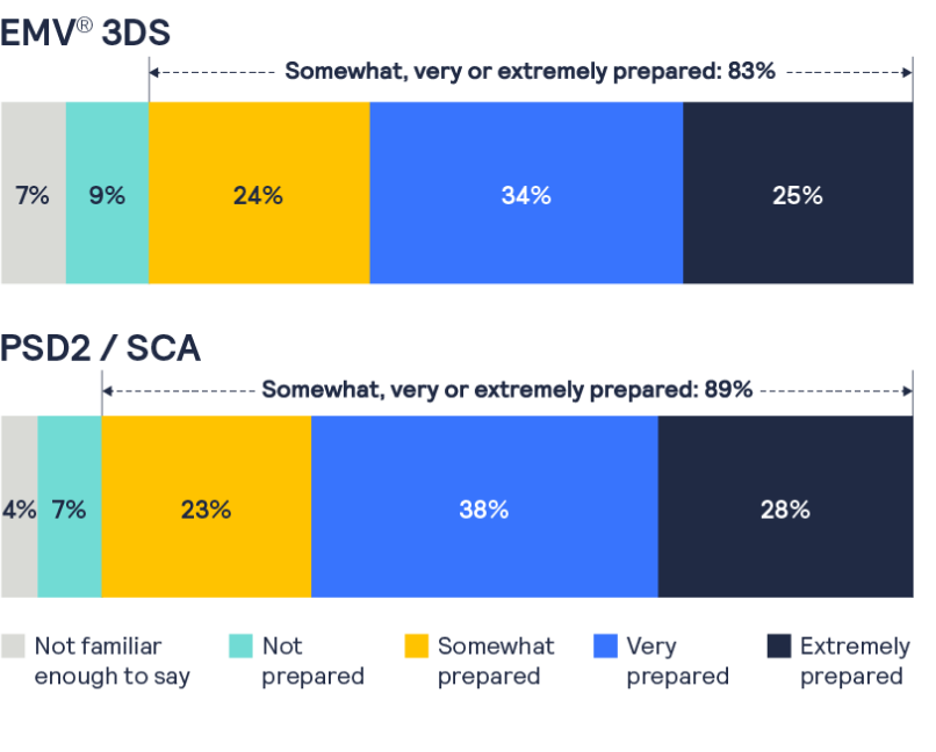

Regulatory changes are a potential minefield for merchants, but those we surveyed are generally pretty positive about incoming rules on customer authentication.

As the graph below indicates, merchants are feeling confident about the industry-wide implementation of EMV-3DS. Meanwhile changes to the EU’s Payment Services Directive (PSD2) are expected to have a major impact on organizations doing business in/with Europe. Here too, the vast majority of merchants feel at least partially prepared.

Merchant preparedness for EMV® 3DS and PDS2 / SCA 5

Cybersource

To find out more download the Cybersource and Merchant Risk Council’s 2022 Global Fraud and Payments Report

1 2022 Global Fraud and Payments Survey Report, MRC. Figure 4, p7 2 2022 Global Fraud and Payments Survey Report, MRC. Figure 5, p8 3 2022 Global Fraud and Payments Survey Report, MRC. Figure 6, p9 4 2022 Global Fraud and Payments Survey Report, MRC. Figure 16, p18 5 2022 Global Fraud and Payments Survey Report, MRC. Figure 8, p11