Intent-based networking in the world of finance – Cisco Blogs

The world of finance has changed considerably in recent years. There has been an appearance of new dynamics, like the rise of fintech firms and the prioritization of worker safety and wellness. With recent events, there has also been a significant acceleration of existing digital transformation trends, like cloud services, digital banking, and virtual experts.

Networking teams are left asking, how do we successfully support these accelerating trends? How do we support new hybrid physical/virtual work models, deliver a seamless online customer experience, simplify secure access to multicloud apps—all while improving the security, flexibility, and operational efficiency of the network?

All these goals can be made attainable with Cisco Intent-Based Networking solutions:

- Cisco ACI for data center automation and Cisco Network Assurance Engine allow companies to identify and solve problems before they occur.

- Cisco SD-WAN solutions help expand the scope of telecommuting work arrangements for employees by allowing personnel to work outside of the office, or both outside and inside the office in a hybrid work environment.

- Additionally, Cisco DNA gives IT time back from time-consuming, repetitive network configuration tasks so they can focus on the innovation their business needs.

To better understand some of the challenges financial services companies are facing today, I’d like to take you through a few examples of financial services firms partnering with Cisco and deploying IBN solutions for their digital transformation.

Tokio Marine and Nichido is not only Japan’s first insurance company but also its largest domestic corporation, with an expansive history spanning more than 140 years.

The company has been actively involved in trying to reform work styles by, for example, expanding the scope of telecommuting work arrangements for all employees and allowing personnel to work outside of the office. Consequently, Tokio Marine and Nichido made the decision to build a new concept branch office network capable of responding to digital transformation by leveraging changes in working styles, the cloud, and fat applications. As part of its secure base infrastructure project, the company rolled out Cisco’s wireless LAN and SD-WAN solutions.

After Partnering with Cisco, Tokio Marine and Nichido experienced some great outcomes:

As you can see, the company implemented a secure base infrastructure leveraging Cisco wireless LAN and SD-WAN solutions. It built a new network foundation capable of supporting the increasing pace of digitalization and work style reforms.

PostBank provides top-notch financial services to over 13,000,000 customers every day and everywhere. Some of the challenges that come with serving so many customers include providing a seamless online experience, pushing network changes quickly without downtime, and rolling out new application features quickly.

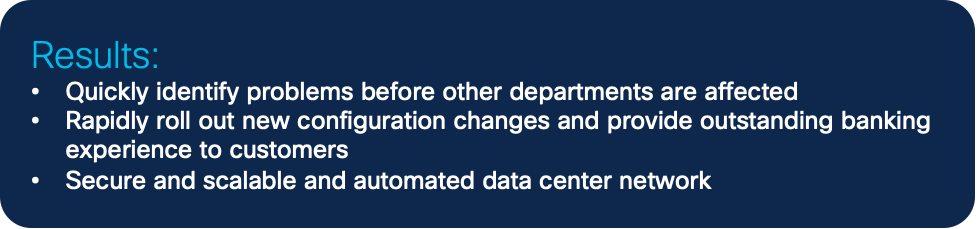

After partnering with Cisco, PostBank decided to use Cisco ACI for data center automation and Cisco Network Assurance Engine to identify and solve problems before they occur. Here are the results:

In the near future, PostBank will extend its data center operations to the cloud with ACI Anywhere and its partner solution with Amazon Web Services (AWS) and Microsoft Azure.

Farm Credit Mid-America works hard to secure the future of rural communities and agriculture. From equipment and operating loans, home and construction loans, to crop insurance, Farm Credit Mid-America stands with rural America and helps farmers succeed.

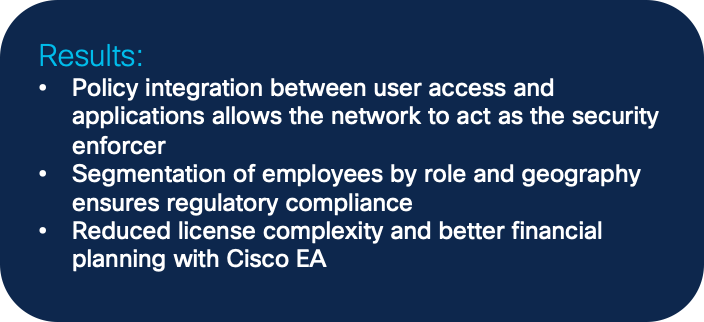

Mike Everett, Farm Credit Mid-America’s Vice President and Chief Security Officer, is at the forefront of the association’s commitment to serve rural communities. To adequately serve constituents, Mike and his technology team realized that they needed to transform business processes, evolve IT, and advance their networking architectures. Mike explained how the team made the decision to implement a Cisco DNA based network:

“We had both business and technical reasons. We are growing our consumer lending program and bringing on new employees. There are increasing regulatory policies we need to comply with. On the technical side, we needed a scalable platform that could handle the needs of our employees as well as help deliver the best possible experience to our customers. Therefore, I decided to move away from the standard route switch topology that everyone has with all its limitations and invest in Cisco DNA that could help us achieve a dynamic network that is constantly adapting to meet business and technical requirements.”

With a little help from Cisco DNA, Farm Credit Mid-America is striving for the success of rural America—with more personal customer service, robust end-to-end data privacy, and secure transactions. Cisco DNA delivers an open, extensible, software-driven architecture that accelerates and simplifies the association’s entire enterprise network operations, while lowering costs and reducing risk. Cisco DNA gives IT time back from time-consuming, repetitive network configuration tasks so they can focus on the innovation their business needs.

Conclusion

To learn more about Cisco in financial services, check out our FSI home page, recent blogs, podcast discussions, and more financial services customer deployments. Contact Cisco Sales for more information about the solutions mentioned in this post.

Subscribe to the Networking blog

Share: