- This Google Chrome update could change the fundamentals of browsing - here's who gets to try it first

- Why I recommend this 6-in-1 USB accessory to every MacBook Air user - especially for work

- I just watched Gmail generate AI responses for me - and they were scarily accurate

- Law Enforcement Busts Initial Access Malware Used to Launch Ransomware

- How IT and OT are merging: Opportunities and tips

Seeing the Light at the End of the Tunnel

The future is fiber, and the present is Data Over Cable System Interface Specification (DOCSIS). What is the right investment profile to get from today to tomorrow? To aid Cable Operators with their investment planning, this blog shares a few strategy and technology options from a CTO’s viewpoint.

Fiber to the Home (FTTH)

There is an inevitable shift ahead from DOCSIS to passive optical networking (PON). The DOCSIS journey went from 1 Mbps to 1 Gbps, with an extension to 10 Gbps. Fiber is starting at 1 Gbps, currently at 10 Gbps, and is headed to 100 Gbps. There are multiple Communication Service Providers (CSPs) today who are offering 5×5 Gbps and even 8×8 Gbps service over 10 Gbps symmetrical (XGS) Passive Optical Network (PON). Cable operators deploy both classic HFC as well as fiber to the home (FTTH), so they are uniquely positioned to benefit from the continued broadband investment.

The United States government is committing $99B into broadband funding over the next several years, with many programs targeting PON (3). By my calculations, there is enough funding to wire most of the USA with PON (4). This drastically lowers the economics and accelerates the timeframes of PON. The blog, Three Reasons to Prepare for Your Next Broadband Infrastructure Investment, offers more details on how a Cable Operator can be ready for Federal funding.

Even with this infusion of funding, PON and HFC plant upgrades may be slowed by supply and labor shortages. A recommendation could be for operators to set aside a percentage of the government funding for education and training to help develop the necessary workforce for PON deployment. This option will be discussed by the Cable Industry’s education association, which is hosting Cable-Tec Expo, in Philadelphia this week, the first in-person gathering in over 2 years.

PON has an interesting investment story. Once installed, subsequent migrations to new technology can be placed on different wavelengths. That means the passive fiber plant does not have to be rebuilt as PON moves from 2.5G, to 10G, to 25/50G, and eventually to 100G. A passive fiber plant also has fewer maintenance costs. There are even some exciting PON technologies that use fiber taps instead of splitters (5) that can reduce the amount of fiber and splicing needed in a plant.

FTTH = FTTC + Drop Cable

Let’s take a look at PON from an installer’s viewpoint. There will be one crew that builds the network down the street. That involves laying conduit, blowing fiber bundles through them, and then fusion splicing the various fiber bundles together. That is fiber to the curb (FTTC). Then there is a subsequent crew that installs the drop fiber to the home and installs the CPE. So, an operator would first build a FTTC network, and then later add drop cable to create FTTH occurrences.

One public baseline cost for FTTC in urban is $1000/HHP (so, not including the drop cable and CPE costs) (6). For multiple dwelling units (MDUs), this would be less, and for rural, this would be more. A rough number for a drop cable install and CPE is $450.

This investment in fiber can then get adjusted to account for:

- how much government funding is received,

- multiple generational use (10G to 100G), and

- the lower operational costs of fiber.

It is up to each operator to do this calculation, but an HFC upgrade would have to come in less than the adjusted cost of fiber.

We have looked briefly at PON. Let’s now look at the current choices for HFC and DOCSIS and see how they compare. Then you can determine how your broadband is holding up.

Spectrum

In the mobile world, telcos may purchase 20 MHz of nationwide spectrum for billions of dollars. In HFC, spectrum also has a cost, and that is of cost of rebuilding and/or retooling of the HFC plant.

HFC plant spectrum is determined by the nodes, amps, passives, and quality of the coax. While it is conceivable to upgrade the nodes and amps, upgrading all the passives such as taps is a bigger time and financial commitment.

Does it make sense to pay for new spectrum when you can free up old spectrum?

An alternate way to add spectrum to DOCSIS is to repurpose the digital video spectrum from the Moving Pictures Expert Group Transport Stream (MPEG-TS) video to IP video over DOCSIS. The trick is to do this while retaining the video revenue. A complete IP video solution will be needed for PON anyway so that investment will get made. Applying that IP video solution to HFC could be a much more cost-effective way of increasing DOCSIS spectrum than extending the DOCSIS spectrum. If you keep MPEG-TS video and pay for more spectrum for DOCSIS, one important perspective is that you are really investing to keep video in the spectrum.

Each 6 MHz video channel is equivalent to almost 60 Mbps of data spectrum (with 4K OFDM). That means 64 channels (384 MHz of spectrum) of video would be worth almost 640 Mbps, which would approximately double the DOCSIS spectrum on an 862 MHz plant.

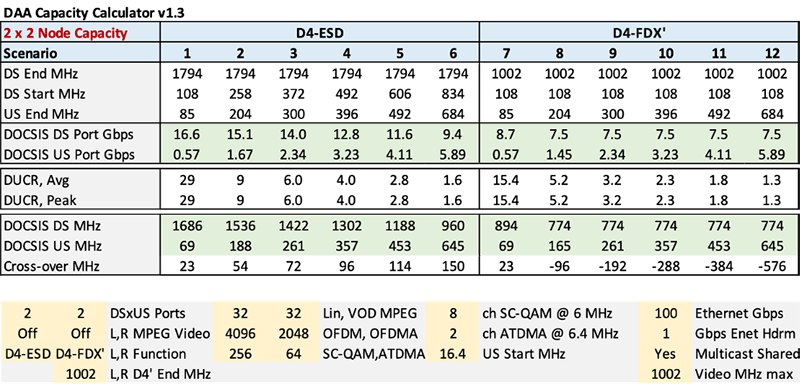

The DAA Capacity Calculator (7) in Figure 1 shows the D3.1 spectrum with 64 channels of video present. HFC plants with less than 1002 MHz of spectrum will be limited to gigabit services or less. In fact, the conversion of video spectrum should be prioritized in the areas of the HFC plant that have less spectrum.

The observation here is that HFC, like mobile, can be measured by how much it costs to obtain spectrum, and how re-purposing spectrum may be cheaper than buying new spectrum.

DOCSIS 3.1

While DOCSIS 3.1 (D3.1) supports up to 1218 MHz in the downstream (DS), many HFC plants are still at 650, 750, 862, or 1002 MHz. Figure 2 shows that if all the video spectrum is converted to DOCSIS spectrum, these older plants can support 5 to 9 Gbps in the downstream.

D3.1 also supports 42, 85, and 204 MHz return paths. The 204 MHz return path offers about 1.7 Gbps (2 ATDMA plus 2K OFDMA channels), which will support 1 Gbps upstream (US) services. Combined with the downstream, that would allow D3.1 to offer 5×1 Mbps to 8×1 Mbps (DSxUS) service offerings which have the potential to be competitive with 2.5G and 10G PON.

85 MHz is another return path option. It will allow approximately 400 Mbps upstream service instead of 1 Gbps, which may be good enough, and matches current Wi-Fi performance. It can also be done with the existing HFC plant and existing cable modem termination systems (CMTS). A 204 MHz return path requires the Distributed Access Architecture (DAA) or a new proprietary digital return path. Also note that a 1218×204 MHz HFC plant has about the same downstream spectrum as a 1002×42 MHz HFC plant.

The capacity of DOCSIS 3.1 has not been fully realized in deployment. Realizing the potential of DOCSIS 3.1 within existing HFC plant could prove to be very cost-effective.

DOCSIS 4.0 ESD

DOCSIS 4.0 (D4.0) ESD (extended-spectrum DOCSIS) extends the upper frequency of the HFC plant as high as 1794 MHz, with future options of up to 3 GHz (8)(9). The upside of ESD is slightly more downstream spectrum and the opportunity to move the return path to 396 MHz or 492 MHz.

The challenge of D4.0 ESD is the cost and time of replacing all the passives. For every single node, there could be 20 amplifiers and over 100 passive taps. If passives are to be replaced, it makes sense to replace them with 1794 MHz or higher components.

D4.0 ESD has also been historically coupled with the Remote MAC/PHY (RMACPHY) project which essentially puts a Layer 2 CMTS in the fiber node. This re-invention of the CMTS footprint has complicated the deployment of ESD without adding any significant features over Remote PHY (RPHY).

ESD with RPHY would be an easier technical solution as the RPHY DOCSIS and Video cores would be compatible, and the Remote PHY Device (RPD) would need upgrading. RPHY was invented by Cisco in 2005 (10) and revised in 2013 (11). In comparing RPHY to the mobile 5G architecture, the RPD is effectively a “DOCSIS radio.” The RPD is like an open radio access network (ORAN) radio unit (RU) with the RPHY Cores being akin to the distributed unit (DU)/centralized unit (CU) and 5G Core. RPHY was an inspiration that created the Small Cell Forum (SCF) 5G network functional application platform interface (nFAPI) split 6 (12). The RPHY future roadmap still has lots of potential ahead of it on reducing latency for long converged interconnect network (CIN) paths and convergence with mobile.

DOCSIS 4.0 ESD requires a significant upgrade to the HFC plant that includes nodes, amps, passives, and some coax. ESD operation is a minor extension to the DOCSIS and RPHY protocols. Coupled with RMACPHY, though, it becomes much more complex to roll out.

DOCSIS 4.0 FDX

D4.0 full duplex (FDX) retains the same downstream spectrum while extending the upstream spectrum by sharing a portion of the downstream spectrum with the upstream spectrum. The major upside of FDX is that the plant passives can be retained if there is already enough downstream bandwidth. This lowers the deployment cost and deployment times.

FDX DOCSIS was first invented at Cisco in 2014, shared with the industry in 2015, demonstrated a Node/Amp system at ANGA in 2017, and product released in 2018 (13).

FDX DOCSIS is unique from other previous FDX technologies by at least three ways:

- FDX DOCSIS is point to multi-point, while previous FDX technologies were point-to-point. This required the unique development of interference groups (IGs) and transmission groups (TGs) to managed cable modems (CMs) that are geographically adjacent to each other.

- FDX DOCSIS operates on an active plant with a chain of echo cancellers (ECs) in the attached nodes and amps. Previous wireline and wireless FDX technologies were single hop.

- FDX DOCSIS spectrum is 576 MHz, which is much more spectrum than wireless or telephony technologies used

The challenge for FDX is the potential cost and complexity of echo cancellers (ECs) based on digital signaling processing (DSP) that must be added to the nodes, amps, and CMs. FDX is also challenged in an amplified network due to multiple ECs and cascaded IGs. Market timing is also an issue. When FDX finally does become available for mass market, it must be compared to PON from a long-term investment viewpoint for cost and throughput.

Here are some interesting observations on FDX DOCSIS that can be seen in figure 3.

- FDX DOCSIS does not add any downstream spectrum. Instead, it retains the DS spectrum when the upstream spectrum is increased. Thus, the investment in FDX DOCSIS is really for a faster upstream.

- A 750 MHz plant could benefit more from FDX DOCSIS than a 1002 MHz plant, as a 750 MHz plant has less downstream spectrum, and will lose a higher percentage of its spectrum to an upstream upgrade.

- A 1002×85 MHz plant without FDX has 120 MHz (1.2 Gbps) more maximum downstream data bandwidth than a plant with FDX enabled, due to the 120 MHz FDX keep-out zone, which allows MPEG-TS video but not DOCSIS.

FDX DOCSIS upgrades the nodes, amps, and CMs with echo cancellers. This is new and complex technology, but if there is already enough downstream spectrum, FDX DOCSIS does leave the passives in place, which lowers costs and time to market. Navigating your network’s transformation is a comprehensive end-to-end journey. Cisco can help to guide the way.

Summary

Cable operators have multiple options available:

- Overbuild with PON

- Rebuild with DOCSIS 4.0 ESD

- Upgrade with DOCSIS 4.0 FDX

- Keep D3.1, add a 85 or 204 MHz upgrade, and selectively migrate MPEG video to IP video

These are sorted in descending cost, absent of other considerations. The elephant in the room is that with US government supplemental funding, multi-generational 10G to 100G benefits and competitiveness of fiber, and lower operating costs, this list may be sorted quite differently.

Due to technology and competitive pressures, options 2 through 4 also infer deferring fiber investment and deployment to a later point in time. The cost of fiber is not eliminated, but it is postponed, which may make sense for some business cases but not in others. Overbuilding the HFC plant with PON was not a practical consideration in Canada and the United States until the recent government initiatives. The rest of the world, including large parts of Mexico and Europe, have already migrated to a PON first approach.

Most of the DOCSIS options allow approximately a 5×1 Gbps service offering, with D4.0 allowing up to 5×3 Gbps offering. While this should be sufficient to compete with an equal or slightly higher offering from FTTH, the real decision should be based on the value of the investment.

Interested in learning more? Meet with Cisco at SCTE Cable-Tec Expo this week. I’ll be there along with a few colleagues to discuss this topic and more. Cisco is proud to be sponsoring the SCTE Awards Luncheon. Can’t make it to Philadelphia this week. Check out this video which takes a deeper dive into these topics.