- Win or Lose: Using CMMC 2.0 Proposed Rule to Position Yourself for DOD Contracts

- The $20 million Apple Watch settlement could mean a payout for you - here's how to qualify

- I tested the standard Galaxy S25, and it beats Google and Apple's offerings in several ways

- This $200 Motorola has no business being this good for the price

- If you use Ring, this is the doorbell I recommend most (and it's easy to install)

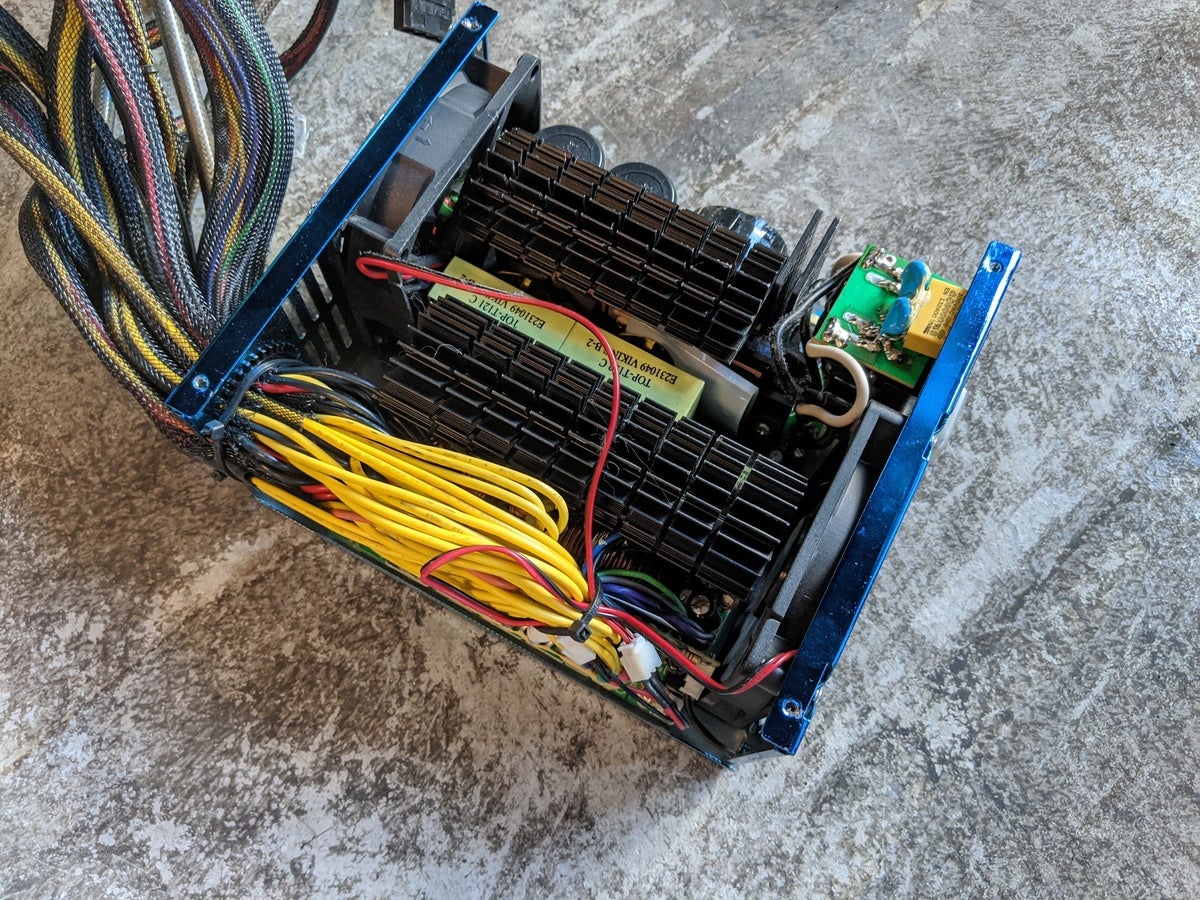

Shortages force network vendors into creative product redesigns

Supply chain problems have triggered most major networking players such as Cisco, Juniper, Arista, and others to redesign or re-engineer some products in an attempt to overcome component shortages and deliver products to customers.

Lead times for some routers, switches and other gear is already delayed well beyond six months. Retooling to get hardware out the door can add is own delay and put additional pressure on engineers looking to reshape things like power supplies and board-level features without causing major problems themselves.

And from all accounts, it is the multitude of smaller, somewhat older components of switches and routers that are causing the most problems.

Speaking at a Goldman Sachs conference this month, Arista CEO Jayshree Ullal said that if there is a commonality amongst semiconductor shortages it is older 100-nanometer and larger chips that are used in things like analog and solid-state devices or power converters.

“Technically, the fab capacity and the availability of that should be easier, but right now, there is a shortage even there,” Ullal stated. “And there are also very simple logic components—like power controllers, ICs [integrated circuits], AD/DA [analog to digital and vice versa] converters, logic devices—that are not mainstream connectivity, but then you still need them to run to build your entire system. So, it’s down to 10 to 20 components that are very simple, that are causing us the greatest shortage.”

The ‘golden screw’

Indeed it is that issue causing the most problems across the industry.

“If any of the components is missing, the product can’t ship. Companies can have 99 out of 100 components to finish a product, but the one shortage can stop production and hold the product from being shipped. That is the golden-screw phenomenon [one ideally perfect, small bolt that could finish a product] that manufacturers are talking about,” said Sameh Boujelbene, senior director at Dell’Oro Group.

“This varies by vendor and by products as they have to make a judgment call on which components would be the most constraining factor (i.e with the longest lead times). What we heard about recently are analog integrated circuits for power supplies but there certainly could be others,” Boujelbene said. “The consistent feedback we have been getting over the recent quarters is that it is currently impacting more downstream commodity components.”

“Each part for each device has a separate story, and we’ve seen some suppliers that are trying to increase capacity, but don’t have access to equipment or they are waiting for orders that are also constrained by semiconductors. So the challenges are across the board and very specific to each device,” Ullal said in a financial call earlier this year.

This includes forcing enterprises to make their own adaptations to navigate the shortages, and in some cases causing vendors to make a changes to networking gear.

One Cisco executive said recently: “What we started doing sometime late last year and certainly the first six months of this year is really looking at redesigning components which were choked, trying to remove those redesigns, and those redesigns take time.”

At the time Cisco said one of its switches and one wireless system had seen some redesign and supply was now getting better, but it declined to be more specific about which products those were. In fact none of the vendors contacted for this story wanted to talk about specific redesigns or other changes they may be making as a result of supply chain problems.

What is a redesign?

Redesigns typically focus on printed circuitboards where the vendor might now need to use a component it normally wouldn’t because say, its normal supplier and backup suppliers don’t have the part, experts say. So engineers need to figure out how to make the connectivity pins and other pieces of those components work on the board, design that into an existing product and then ensure they can repeat that in a way to help meet demand.

Conceptually, if it’s a rational engineering organization, it would look at what the biggest impact is from the fewest number of changes, said one industry observer. Vendors are not going to change every product, but they will look at products that have the most impact.

“The primary focus has been around consolidating hardware designs wherever possible, so that there’s more component similarity, if not uniformity, between discrete device categories and classes. Sometimes that’s not possible, of course, but it should be pursued as a general rule to simplify supply-chain procurement and to bring greater consistency to delivery schedules,” said Brad Casemore, research vice president, Datacenter and Multicloud Networks at IDC. “Similarly, if Cisco or another vendor finds that a specific supplier or part has been problematic, they’ll seek design or supply alternatives.”

For customers it should be reassuring to hear that their suppliers are re-designing products to accommodate different components and diversify their supply chains. Boujelbene said. “Some vendors were also willing to pay higher broker and expediting fees to ensure on-time product deliveries to their customers.”

For better or worse, almost all major vendor have used brokers, and paid a higher price to procure hard-to-get parts. But the idea is the same: Vendors can either build a product or get parts from brokers with some slight changes that customers probably don’t care about. Or they can wait for the supply chain to settle and take delivery when things are more available, experts said.

Fewer ASICs?

One of the possible results of the supply shortage and system redesign may be reduction in use of custom chips and ASICs found in some Cisco, Juniper, Extreme, and other equipment, experts said.

“Every vendor has a few chips here and there that they’re trying to source or get an alternative for and, I would speculate that what they might be looking at doing was changing out some of the custom chips they had developed and almost certainly cannot produce in house for more standard industry chips,” said Tom Nolle, president of CIMI Corp. “The whole custom-chip thing was, for vendors, a bit of a PR play. Commercial silicon from companies like Broadcom would be a better and cheaper option, long-term, and for the customers it would likely end up better, too.”

Another result, has been an uptick in sales of software and virtual form factors for network functions, such as application delivery controllers, IDC’s Casemore said. ADCs are network appliances that can bolster performance and security of cloud applications.

“Our assumption is that this is partly due to the greater availability of industry-standard hardware as opposed to fixed-function hardware appliances,” Casemore said. “Similarly, multivendor automation and orchestration systems, as well as open-source networking software (such as SONiC—the open-source network operating system), has experienced a sales boost.”

“In some cases, we have noted that customers were drawn to the greater flexibility and choice that such software facilitates in the face of supply-chain complications,” Casemore said.

Copyright © 2022 IDG Communications, Inc.