- Yes, your internet provider can throttle your speed. Here's how to stop it (or at least try to)

- Half of Firms Suffer Two Supply Chain Incidents in Past Year

- Data strategy e qualità del dato: come gettare le basi per implementare l’AI

- INE Security Alert: $16.6 Billion in Cyber Losses Underscore Critical Need for Advanced Security Training

- From help desk to AI harmony: Redefining IT support in the age of intelligent automation

Your Guide to Protecting Your Credit | McAfee Blog

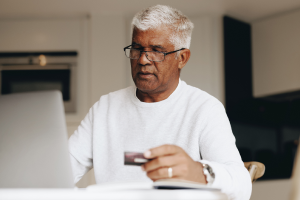

It has a way of sneaking up on you. Credit theft and fraud.

Maybe it’s happened to you. Maybe it’s happened to a friend or family member. There’s a call from the bank, a notification in your financial app, or a charge on the statement that’s beyond explanation. Someone else has tapped into your funds. Or worse yet, someone stole your identity and took out a loan in your name. You find out only after it’s happened.

That’s the trick with credit theft and fraud. People typically discover it after the damage is done. Then they’re left picking up the pieces, which can cost both time and money. Not to mention a potential knock to their credit score.

However, you can help keep it from happening to you. Our recently published Credit Protection Security Guide breaks down several ways. Here we’ll get into a quick introduction on the topic and show how you can prevent against credit theft and fraud better than ever before.

Protecting yourself from credit theft and fraud

It’s an unfortunate reality in the world we live in today. Credit theft and fraud are something we all need to look out for, particularly as we increasingly shop and conduct our finances online, potentially exposing that information to thieves. Some figures estimate that for nearly every $100 in purchases made with debit and credit cards worldwide, somewhere around 7 cents can be stolen or fraudulent. As you can imagine, that figure adds up quickly, to the tune of more than $28 billion globally each year.

The flipside is this: today we have plenty of tools that make protecting our credit far easier than they ever were before. Up until now, that called for a time-consuming and sometimes rather manual process. You had to check credit separately with the different bureaus, place locks and freezes the same way, scan each credit report closely for suspicious activity, and so forth.

Now, online protection software can take much of that work off your hands. Comprehensive protection like McAfee+ has plans that offer credit monitoring, identity monitoring, and even identity theft protection & restoration—all quickly spotting any changes, notifying you if your personal information pops up on the dark web, and providing $1 of coverage toward restoring your credit along with the help of a licensed recovery pro if the unexpected happens to you.

Leaving less of a trail for thieves to follow

Another thing online protection can do for you removes your personal information from those “people finder” and data broker sites. Identity thieves lean on those sites because they contain valuable information that they can piece together to commit theft and fraud in someone else’s name. If you think about your identity as a big jigsaw puzzle, these sites contain valuable pieces that can help complete the picture—or just enough to take a crack at your credit.

In fact, personal information fuels a global data trading economy estimated at $200 billion U.S. dollars a year. Run by data brokers that keep hundreds and even thousands of data points on billions of people, these sites gather, analyze, buy, and sell this information to other companies as well as to advertisers. Likewise, these data brokers may sell this information to bad actors, such as hackers, spammers, and identity thieves who would twist this information for their own purposes. In short, data brokers don’t discriminate. They’ll sell personal information to anyone.

Getting your info removed from these sites can seem like a daunting task. (Where do I start, and just how many of these sites are out there?) Our Personal Data Cleanup can help by regularly scanning these high-risk data broker sites for you and info associated with you like your home address, date of birth, and names of relatives—along with other detailed information about you that could include marriage licenses, voter registration and motor vehicle records, even real estate records too. It identifies which sites are selling your data, and depending on your plan, automatically requests removal.

Take control of your credit

How things have changed. Even as thieves have gotten savvier in the digital age, so have we. Collectively, we have a growing arsenal of ways that we can keep on top of our credit and protect ourselves from credit theft and fraud.

Our Credit Protection Security Guide breaks it all down in detail. In it, you’ll learn more about how thieves work, ways you can secure your credit online and off, how to monitor and lock it down, plus protect your mobile wallets too. It’s thorough. Yet you’ll find how straightforward the solution is. A few changes in habits and a few extra protections at your side will go a long way toward prevention—helping you avoid that call, text, or notification that your credit has been compromised.

In all, you can take control of your credit and make sure you’re the only one putting it to good use.