- Arc reinvented browsing for the better - and that was apparently the problem

- Why I prefer this rugged Samsung phone over flagship models (and it looks just as good)

- Can a home wind turbine replace my solar panels? My results after months of testing

- DragonForce Ransomware Leveraged in MSP Attack Using RMM Tool

- Learn with Cisco: Evolving for the Age of AI, Automation, and Cloud

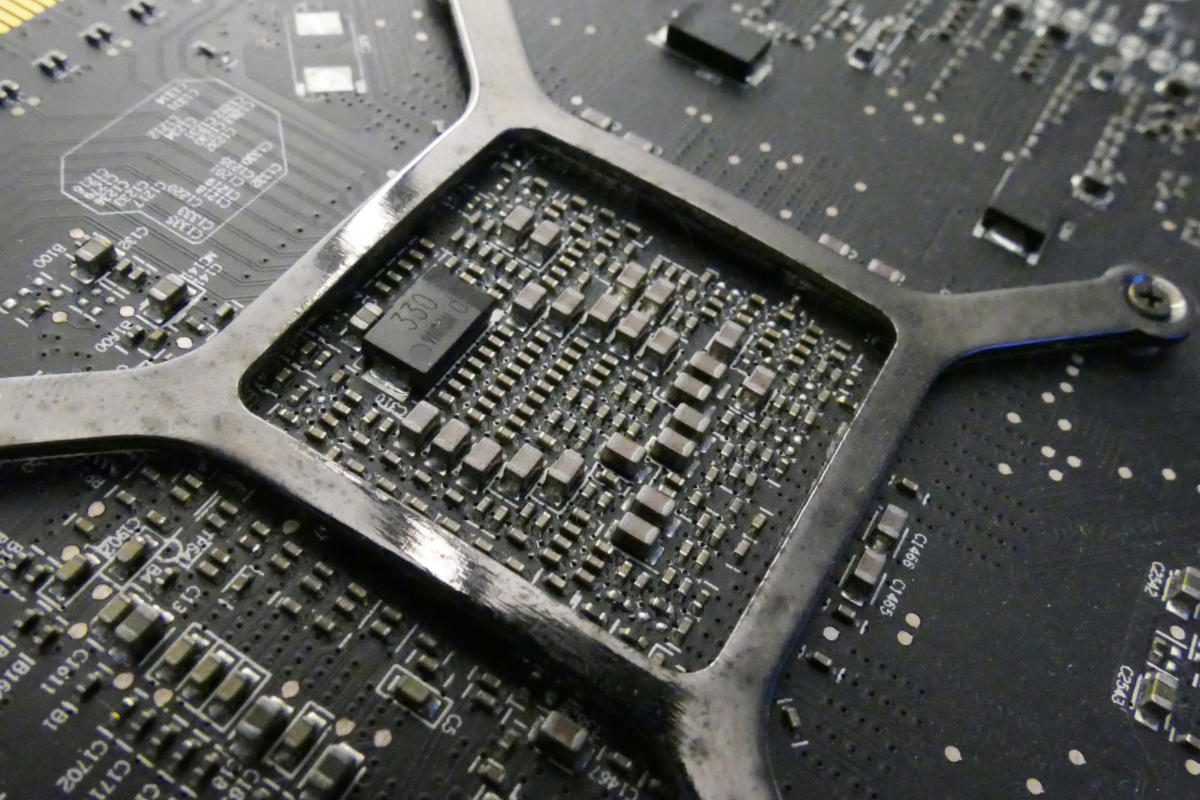

You’re not imagining things, there is a serious chip shortage

If you’ve noticed components are hard to get these days, you are not alone. The supply of computing components can get a little tight around the end of the year but this year is especially bad, much of it due to Covid-19-related issues.

Intel spent much of 2020 struggling with CPU shortages. In the latter half of the year it was hit with chipset shortages, with the B460 and H410 chipsets reportedly out of stock through the end of last year, and availability of the Z590 chipset is also constrained.

AMD also has a problem: it can’t make enough chips. Some of its Ryzen processors, particularly the Ryzen 5 line, are immensely popular, and there are simply none to be had on Amazon, Newegg, or any other online retailer.

In November, Micron’s biggest memory production facilities based in Taiwan suffered a one-hour power outage. That may not seem like much but it means everything on the manufacturing line is scrap. The process of spinning silicon wafers does not tolerate interruptions, which means millions of dollars’ worth of product was ruined.

And those factories don’t just rebound and go back to spinning wafers. Micron needed several days to get it back to normal. Given that factory accounts for 10% of the world’s DRAM production, that’s a huge hit.

As for GPUs, good luck getting anything based on Nvidia’s new Ampere architecture. GeForce RTX 30×0 series cards are impossible to find and CEO Jen-Hsun Huang said on a recent earnings call the shortage won’t ease up until at least this quarter. What supply is available is outrageously expensive and only getting worse, with some cards selling for up to $1,000.

Add to it the chaos in shipping wrought by Covid-19. With everyone staying home and ordering from Amazon, tremendous strain was put on shippers. The Wall Street Journal reported last month that UPS ordered its drivers to stop picking up orders from several retailers, one of them being Newegg.

But it goes beyond that. Jim McGregor of Tirias Research tells me there are parts sitting in cargo containers on docks all around the world and no one to pick them up.

The real problem, he said, was a shortage of chemicals needed for manufacturing components. Some of it is demand for all the new product introductions, but also there has been a surge in demand in China’s automotive segment. “A lot of companies are over-ordering because of a concern of availability of parts. Once you have the illusion of short supply, everyone orders more,” he told me.

Dean McCarron of Mercury Research also said there has been capacity constraint on wafer and packaging substrates for chips, so chip manufacturers are prioritizing parts. “It’s safe to say we are in a shortage environment, and full market demand is not being met,” he told me. “Whenever manufacturers are facing a constrained environment, you build what makes most profit first, so the low end doesn’t get priority.”

And servers are high priority. They get served first no matter what. After all, a Xeon sells for 10-times the price of a Core i5.

The primary issue facing the server market is we are in a slow period for the server market, not supply constraint. Servers have a build/absorb cycle where new versions come out around the time of new chips from Intel and AMD, there is a rush of sales, and new owners take time to get their new hardware installed and running.

The build cycle was in mid-2020 and now customers are taking delivery. Everyone recognized that the end of 2020 and early 2021 would be a time of weakness, but it’s not really driven by supply shortages.

Nobody knows how the market will play out, but we will be in this state of shortage at least thru Q1 and part of Q2, say the analysts.

Copyright © 2021 IDG Communications, Inc.